Do banks make a lot of money?

By Dr. Spiro Brumbulli

Every time there is talk about the profit of the banks, there is increased attention from the public and different opinion-makers. When they hear an absolute figure, for example, “the banking sector secured a profit of 157 million euros for 2021”, the comments begin with negativity: “What a profit! Only the banks make money! They take advantage of us!”

Beyond these populisms, in respect of public opinion and transparency for the profitability of the banking sector, we are making a simple analysis, necessary for anyone to understand.

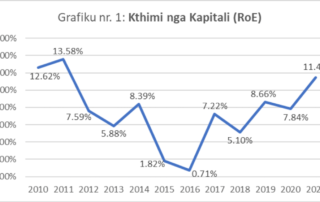

It’s one thing to hear a figure and quite another to analyze it. Chart no. 1 shows the returns on equity (RoE) for the banking industry since 2010. In the 12 years under review, only three times the RoE is in double digits and never in the size of 15-20 percent, which is considered a good figure for the profitability of this sector (because, if it is earned 5-6 years in a row at this rate, then the invested capital is returned and the shareholders feel relieved from the risk of non-return). For nine years the return on equity has hovered in the range of 0.71 – 8.66 percent, well below the estimated acceptable rate.

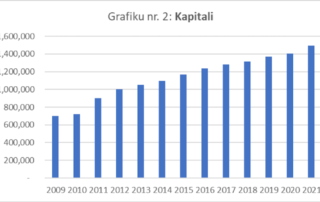

In this presentation, it is important to understand that the return on equity (RoE) is the main indicator used to evaluate the efficiency of the use of capital in the industry. In other words, how many lek do I provide for each lek invested? For example, if the RoE is 11.46%, this indicator means that for 100 ALL invested, the investor receives (returns) only 11.5 ALL. If we look at the capital employed by the banking sector, Graph no. 2, we understand that from 2009 (698 million euros) to 2021 (1,494 million euros) this capital has doubled. So, more capital has been added, has been engaged in banking activity, than has been justified by ensuring the profit in the range of 0.71 – 13.58 percent.

So, the profit of the banking industry for this entire period has not justified the commitment of capital. It is fair to say that the banks have been profitable, just as it is fair to say that the profit is insufficient to justify the commitment of capital. At the end of 2021, the capital of the banking industry is estimated at 180 billion ALL (or about 1.5 billion euros).

The above analysis does not include losses during the exercise of the activity, especially those from the activity of lending (loans). These can cause losses in operations over a year, can affect capital adequacy, and require additional capital (cash to be poured into the bank’s capital account), unlike in many other industries. Except for the financial sector, no other industry has such capital requirement constraints.

Having said this, not to think that “we’re sorry, you ran out of money”, as can usually be written in different statuses, but to understand how the banking industry works and how to judge the size of its profitability.

GALLERY